Working Together

At Brown Edwards Wealth Strategies, we build strong relationships with our clients to better understand their values and dreams for the future. Then we design holistic, evidence-based plans that put our clients on the right path to achieve their goals.

Our Clients Are at the Center of Everything We Do

Brown Edwards Wealth Strategies is part of an alliance of independent advisors, researchers and national thought leaders. BEWS is devoted to helping people just like you achieve their most important goals. Our organization was created with the idea of putting client’s interests first.

How We Serve Our Clients

True Wealth Management

Individuals and families connect their financial lives with their values and goals through tailored wealth solutions, investments and comprehensive financial planning.

Retirement Plans

401(k) plan sponsors benefit from investment management by a 3(38) fiduciary that’s committed to transparency, responsible investment options and participant education.

Institutional Services

Community foundations, continuing care facilities, private schools, cultural institutions and other nonprofits advance their mission and goals with prudent investment management and financial guidance.

Our Comprehensive Services

Desired Lifestyle

Wealth Transfer Intentions

Charitable Interests

Estate Planning

From the Blog

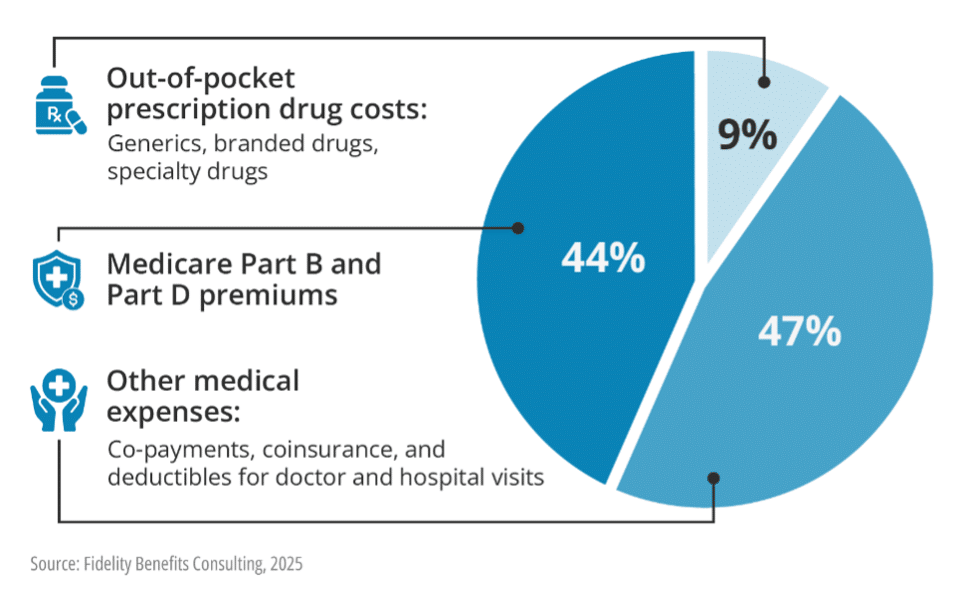

Health Care: The Hidden Retirement Cost You Can’t Afford to Ignore

When you picture your retirement years, you likely imagine relaxed mornings, travel, time with family, and financial security. But behind every retirement dream is a major expense many people underestimate: health care. Rising medical costs can quietly undermine even the best-laid plans, making it essential to understand how this expense impacts your financial security. Building a realistic, sustainable retirement strategy

Key Investment Themes in 2026

In this video, Focus Partners’ Jason Blackwell shares some reflections on 2025 and explores themes to watch out for in 2026. On paper, it was a great year for investors. Looking back on 2025, it may be easy to forget just how challenging it felt at times. The Year in Review Large caps are set for another double-digit gain.

6 Money Lessons for Raising Financially Responsible Children

For some parents, few responsibilities feel as important as teaching kids about money. In a world of instant gratification and often hidden financial mechanisms, it can become even more essential to help them develop a healthy, grounded relationship with their finances. Just as we support them in their academics and life skills, helping them build healthy financial habits early on