Working Together

At Brown Edwards Wealth Strategies, we build strong relationships with our clients to better understand their values and dreams for the future. Then we design holistic, evidence-based plans that put our clients on the right path to achieve their goals.

Our Clients Are at the Center of Everything We Do

Brown Edwards Wealth Strategies is part of an alliance of independent advisors, researchers and national thought leaders. BEWS is devoted to helping people just like you achieve their most important goals. Our organization was created with the idea of putting client’s interests first.

How We Serve Our Clients

True Wealth Management

Individuals and families connect their financial lives with their values and goals through tailored wealth solutions, investments and comprehensive financial planning.

Retirement Plans

401(k) plan sponsors benefit from investment management by a 3(38) fiduciary that’s committed to transparency, responsible investment options and participant education.

Institutional Services

Community foundations, continuing care facilities, private schools, cultural institutions and other nonprofits advance their mission and goals with prudent investment management and financial guidance.

Our Comprehensive Services

Desired Lifestyle

Wealth Transfer Intentions

Charitable Interests

Estate Planning

From the Blog

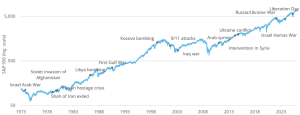

What the Iran Conflict Means for Investors

The U.S. strikes on Iranian targets mark a significant military escalation and raise the risk of a broader regional conflict, adding to an already strained geopolitical backdrop shaped by strategic competition, energy security concerns, and recurring instability. The seriousness of this development should not be understated. At the same time, it does not represent a fundamental shift in the investment regime. Markets

The Future of Financial Planning

April 23, 2026 | 12 p.m. CST In today’s evolving financial landscape, advisors are expected to deliver deeper expertise, faster answers, and more strategic guidance than ever before. Join us for a 45-minute session focused on the key trends reshaping today’s financial planning landscape. Chief Planning Officer Jeffrey Levine will share his perspective on where the industry is headed, the

Geopolitical Conflict and Markets | A Brief History Lesson

Over the weekend, the United States and allied forces attacked Iran. Conflict in the Middle East continues. Lately (and sadly), this has become the norm of unsettling headlines. Consider recent examples: Russia invaded Ukraine, terrorist attacks, missile strikes, civil wars, and even regional conflicts, such as with ICE. If you watch the news, it’s likely you won’t miss these events. Depending on your source, there may be various views on each of these, but this is not the forum to express political or social views.