When you picture your retirement years, you likely imagine relaxed mornings, travel, time with family, and financial security. But behind every retirement dream is a major expense many people underestimate: health care. Rising medical costs can quietly undermine even the best-laid plans, making it essential to understand how this expense impacts your financial security. Building a realistic, sustainable retirement strategy means facing this challenge head-on.

Why health care costs matter so much in retirement

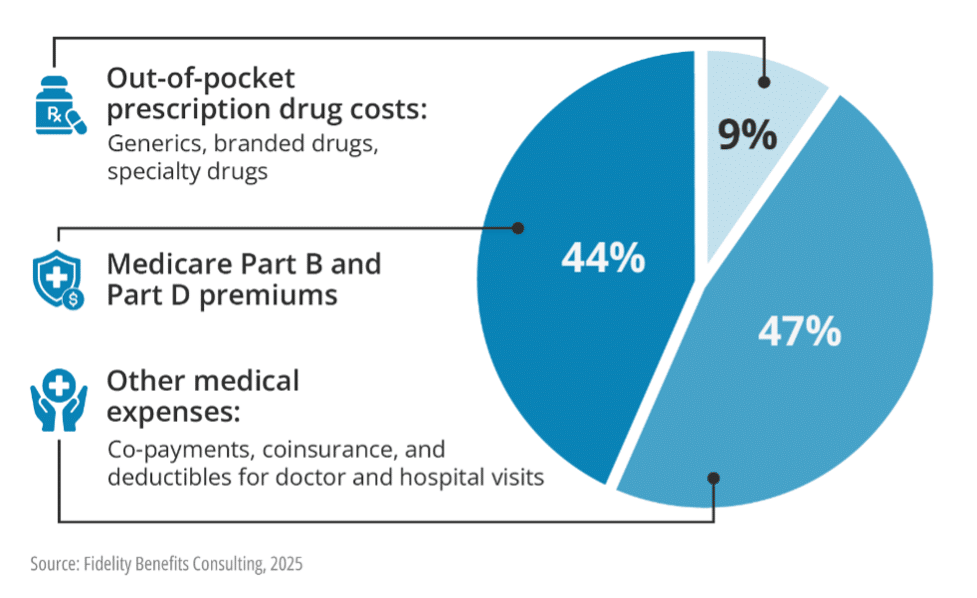

For many people, health care often becomes one of the fastest-growing expenses in retirement. According to Fidelity Investments’ annual Retiree Health Care Cost Estimate, a 65-year-old retiring in 2025 will need about $172,500 to cover health care and medical expenses throughout retirement (not including long-term care).

That number represents a more than 4% increase over 2024 and is astonishing when you consider that it’s just for health care. When you add housing, food, transportation, and leisure, the retirement budget balloons even more.

Several factors amplify this issue:

- Health care inflation tends to outpace general inflation. For example, from 2000 to June 2024, medical care prices increased about 121% while all items rose around 86%, according to the Consumer Price Index data compiled by the Peterson-KFF Health System Tracker.

- Even after qualifying for coverage like Medicare in the U.S., retirees still face premiums, co-payments, deductibles, and large gaps, especially when it comes to hearing, vision, dental, and long-term care. Original Medicare does not cover routine dental, vision, or hearing services, and provides no coverage for custodial long-term care. Many Medicare enrollees may be unaware of these significant gaps.

- As life expectancy lengthens and chronic conditions become more treatable, the retirement period itself grows, meaning more years of medical spending.

What the numbers tell us

Let’s look at some specific data points to illustrate the magnitude of the risk:

- For individuals 65 and older, per capita health spending in 2020 was $22,000, and $35,000 for those 85 and older, according to CMS.gov.

- According to Milliman’s Retiree Health Cost Index, a healthy 65-year-old woman could face approximately $313,000 in lifetime health care costs with Original Medicare plus Medigap and Part D prescription coverage; a man about $275,000.

- Because of the combination of higher costs and longer retirement span, many retirees will find health care to be among their largest expenses.

Taken together, these figures show that unless retirees plan for health care costs explicitly, the “unknown” of health care can make it harder to maintain the lifestyle you have planned for.

Impacts on your retirement years

So, what do these high costs mean in practice? Here are a few of the biggest potential impacts retirees face:

- Risk of spending down assets at a higher rate than expected

Underestimating health care costs is a major retirement planning mistake. Some retirees think they’ll spend $50,000–$75,000 on lifetime health care needs, but professional estimates are more than double that. If funds allocated for health care are insufficient, retirees may deplete savings faster than anticipated. - Forced trade-offs

Retirees may have to choose between delaying retirement, working longer, reducing lifestyle expectations, or moving to lower-cost geographies to offset health care burdens. - Uncertainty and volatility

Health events are unpredictable. A major illness, accident, or long-term care need can add tens or hundreds of thousands of dollars to costs, beyond what even actuarial models may foresee. That uncertainty adds risk to every retirement plan. - Long-term care is often the wildcard

Most of the estimates exclude long-term care, such as nursing homes, assisted living, or extended in-home care. But many retirees will require this care, and Medicare covers almost none of it. Long-term care insurance can mitigate this risk, however costs of premiums—which rise with age—must be factored in. When long-term care is included, total potential health‐related costs grow dramatically and vary based on many factors. - Medical and care costs are often underestimated. A brief from the Center for Retirement Research at Boston College shows that many older households significantly underestimate both the likelihood of high medical/long-term care costs and their magnitude. Financial advisors have an opportunity to help clients with realistic projections.

What you can do to prepare

Given these risks, proactively integrating health care into your retirement strategy is essential. Here are some key steps:

- Budget early and generously: Consider using conservative estimates and build in inflation. As previously noted, health care inflation historically runs higher than general inflation.

- Start saving with intent: Tax-advantaged savings (e.g., HSAs) can be powerful tools. A dedicated “health care fund” within retirement planning can help isolate this expense from other lifestyle spending.

- Plan insurance coverage carefully: Understand your coverage (Medicare, Medigap, Medicare Advantage, and supplemental policies) and premiums. Gaps in vision, dental, hearing, and long-term care should be explicitly addressed.

- Consider long-term care insurance and explore premium costs.

- Stay healthy: Your health status dramatically influences costs. Preventive care, healthy lifestyle choices, and avoiding high-risk behaviors can reduce the frequency and severity of future expenses.

- Consider location and timing: Some states have lower care costs. Also, postponing retirement (or delaying taking Social Security/U.S. retirement benefits) may reduce the time you spend drawing on savings while increasing protection against longevity risk.

- Plan for surprises: Budget not only for routine health care expenses but also for unexpected medical events or long-term care needs. Having a cushion helps you stay flexible.

Conclusion

Health care costs in retirement are potentially substantial and must be factored into any financial planning for aging and longevity. With average lifetime health care costs for retirees in the U.S. reaching into the tens or hundreds of thousands of dollars, the risk of being unprepared is real.

By understanding the magnitude of this potential expense, planning early, and making informed choices about insurance, savings, and lifestyle, you can build a retirement plan that accounts for this key cost. Health care in retirement isn’t simply a background consideration; it’s central to how comfortably and securely you can enjoy your post-work years.

This communication is for informational purposes only. The content does not purport to present a complete picture of healthcare budgeting principles or Medicare, but Focus Partners believes the information is representative of issues and needs facing some clients. This should not be construed as specific investment, tax, or legal advice.

This represents the opinions of Focus Partners and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Advisor Solutions, LLC and Focus Partners Wealth, LLC (collectively referred to in this document as “Focus Partners”), SEC registered investment advisers. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of the RIAs or their representatives. Prior to January 2025, Focus Partners Advisor Solutions was named Buckingham Strategic Partners, LLC, and Focus Partners Wealth was named The Colony Group, LLC. ©2025 Focus Partners Wealth, LLC and Focus Partners Advisor Solutions, LLC. All rights reserved. RO-25-5056544